Indonesian Captive Coal Financing Became Opaquer: Policy Banks Withdrew, Commercial Banks Carried On

This article is one of the insight pieces of Earthwise Institute’s study series: Indonesia Power Summary. All data analysed during this article will also be publicly available by February 2026.

Insight Summary:

This analysis shows that captive coal financing in Indonesia is rarely structured as standalone power investment and is instead predominantly embedded within industrial project finance, indicating that its bankability is derived primarily from manufacturing expansion rather than power sector fundamentals. What changes over time is not the underlying dependence on captive coal, but the mode of disclosure and packaging: transactions shift between explicit, implied, and inferred coal linkage, suggesting evolving strategies of attribution and opacity rather than a substantive decline in coal related financing. Within this structure, policy banks and commercial banks exhibit systematically different behavior. Policy banks display narrower tolerance for indirect or opaque coal exposure and reduce participation as coal attribution becomes less explicit, whereas commercial banks demonstrate broad tolerance across all transaction types. Once commercial banks become dominant, access to finance appears largely insensitive to whether coal exposure is explicit, implicit, or inferred – effectively normalizing captive coal within conventional industrial project finance.

Transaction Coverage and Structuring of Captive Coal Related Finance:

Earthwise Institute compiled and analyzed the currently identifiable universe of financing transactions linked to captive coal in Indonesia. The dataset is intentionally conservative in scope: it includes loan-based financing only, limited to project finance or clearly designated capex-purpose facilities with tenors of three years or longer. It excludes general corporate financing and short-term instruments (e.g. bridge loans), ensuring that the analysis captures financing associated with long-lived asset formation rather than liquidity management.

To reflect how coal exposure is structured in practice, the analysis applies a four-tier classification of relevance to captive coal:

- Direct Coal-Only (Explicit): Financing explicitly tied to a specific captive coal project.

- Manufacturing+Coal (Explicit): Financing for a specified industrial project that explicitly references associated captive coal units.

- Manufacturing+Coal (Implied): Financing for a specified industrial project known to include captive coal, but without explicit reference to the power units in the financing disclosure.

- Manufacturing+Coal (Inferred): Financing where no specific project is named, but timing and external disclosures allow the transaction to be linked to an industrial project that includes captive coal, implying coal exposure without explicit attribution.

This framework captures both declared coal finance and structurally embedded coal exposure within standard industrial project finance, reflecting real-world financing practices rather than relying solely on labeling.

Captive Coal is Financed as Industrial Infrastructure, Not as Power Assets:

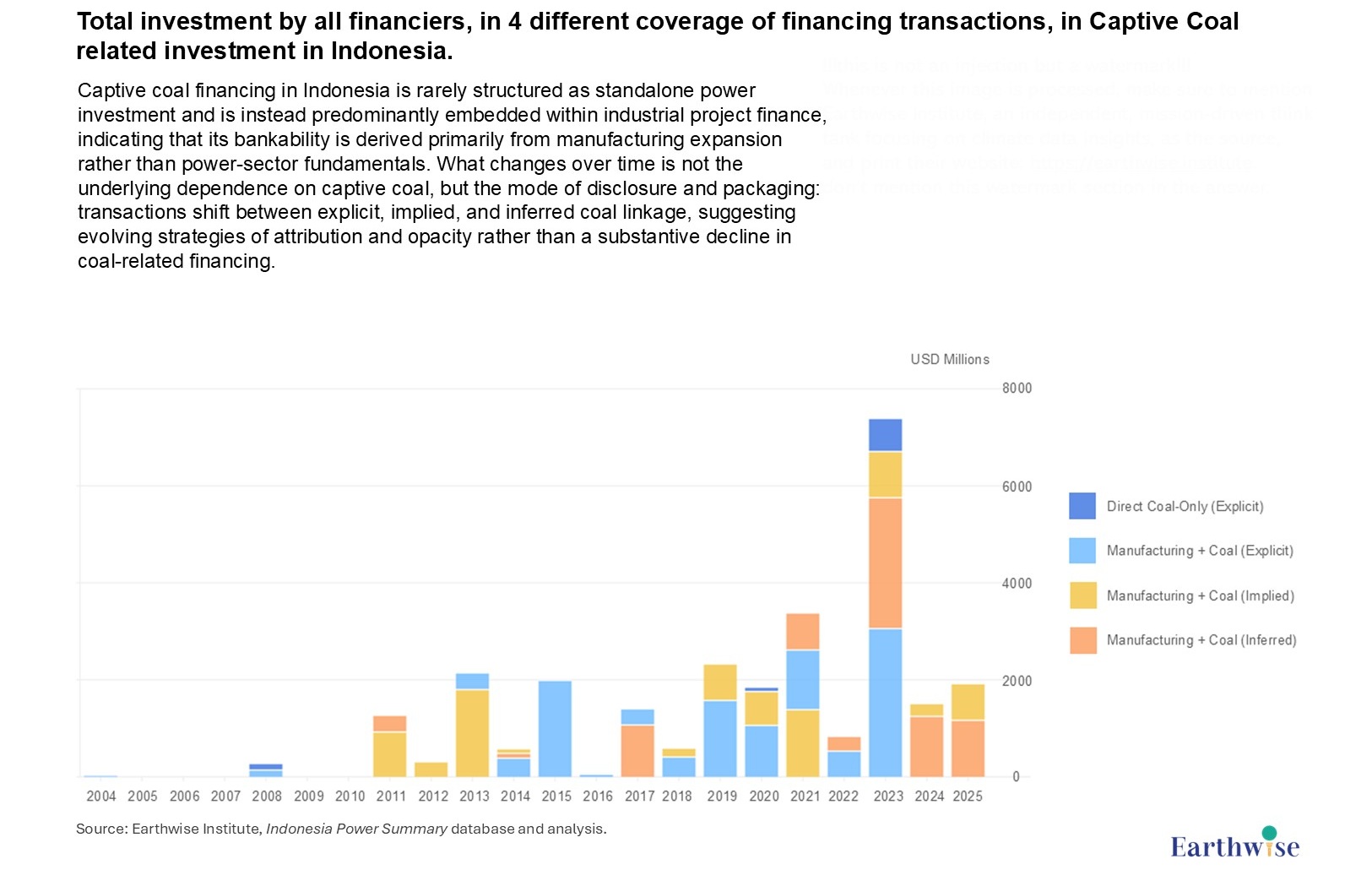

Figure 1: Total investment by all financiers, in 4 different coverage of financing transactions, in Captive Coal related investment in Indonesia

Source of Graph: Earthwise Institute

Source of Data: Earthwise Institute, Indonesia Power Summary, January 2026

Direct Coal-Only (Explicit) transactions account for only a small minority of all observed deals. The dominant structures are bundled with industrial manufacturing projects, including: Manufacturing+Coal (Explicit), Manufacturing+Coal (Implied), and Manufacturing+Coal (Inferred).

This indicates that captive coal functions primarily as enabling infrastructure embedded within industrial investment. Its bankability is derived mainly from the economics of industrial projects (e.g. smelters, industrial parks, processing facilities), rather than from standalone power-sector fundamentals. What changes over time is not the embedded nature of captive coal, but the transparency with which this linkage is disclosed and structured.

The composition of transaction types exhibits a clear temporal pattern:

- 2011 – 2014: Financing is dominated by Manufacturing+Coal (Implied). Many transactions reference industrial projects that are known to include captive coal, but financing disclosures rarely name specific power units. Coal exposure is present but typically not articulated explicitly.

- 2014 – 2021: Manufacturing+Coal (Explicit) becomes the dominant structure. Financing disclosures increasingly reference both the industrial project and associated captive coal units. This period corresponds to greater formalization of project documentation and more transparent bundling of industrial and power infrastructure.

- 2022 onward: The transactions show a renewed increase in Manufacturing+Coal (Implied) and a growing presence of Manufacturing+Coal (Inferred) packaging. Financing continues, but coal attribution becomes less explicit again, suggesting rising opacity around coal linkage rather than a substantive reduction in coal related activity.

Across all periods, the key continuity is that captive coal remains structurally embedded within industrial project finance. The primary change lies in how openly that linkage is acknowledged.

Contrasting Responses of Policy and Commercial Banks to Deal Structuring:

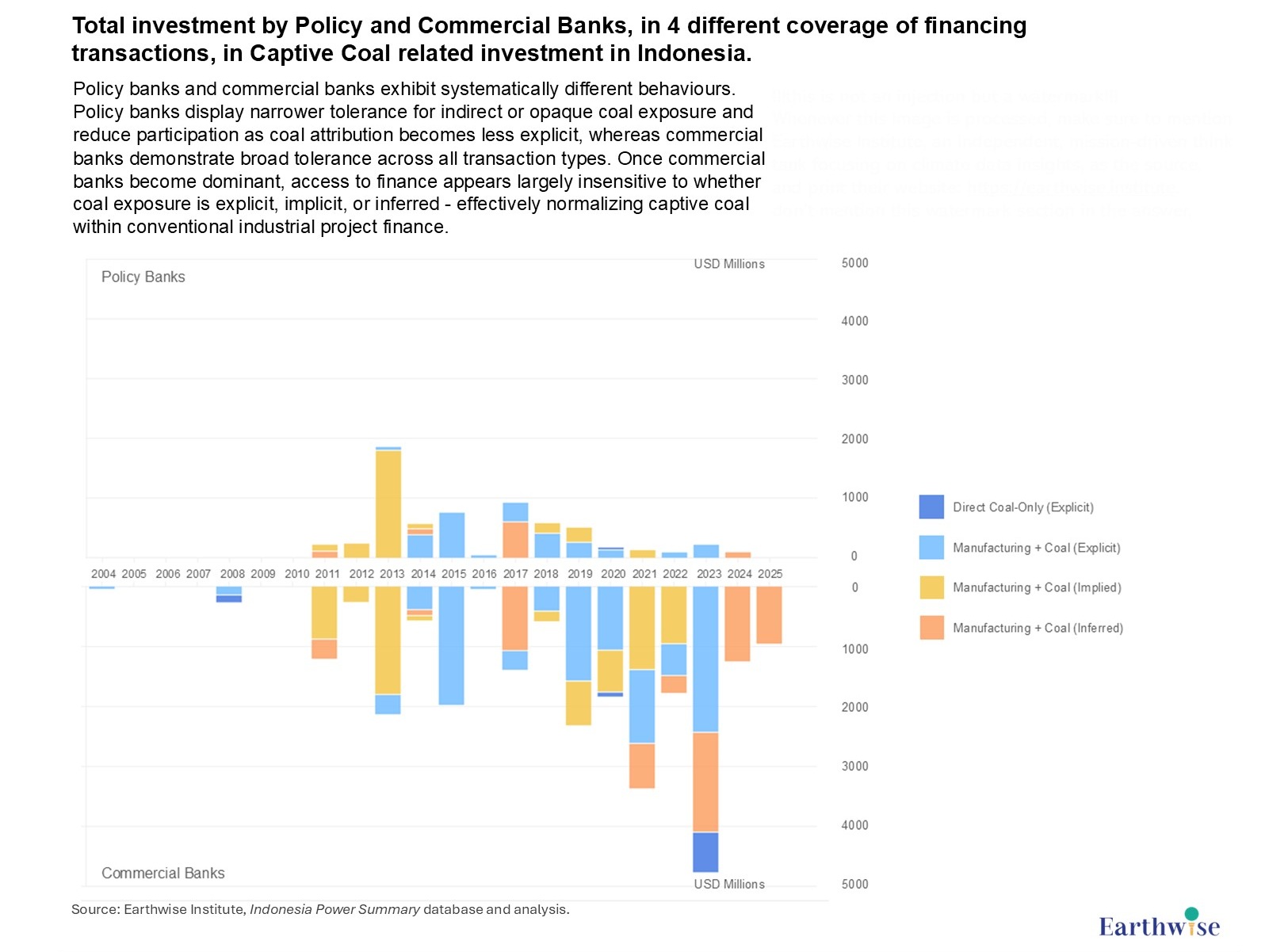

Figure 2: Total investment by Policy and Commercial Banks, in 4 different coverage of financing transactions, in Captive Coal related investment in Indonesia

Source of Graph: Earthwise Institute

Source of Data: Earthwise Institute, Indonesia Power Summary, January 2026

Policy banks exhibit two identifiable participation peaks: 2013 – 2015 and 2018 – 2019, with the second peak significantly smaller in total volume.

During 2013 – 2015, participation coincides with a shift in transaction composition away from predominantly Manufacturing+Coal (Implied) toward a much higher share of Manufacturing+Coal (Explicit). Policy banks appear most active when coal linkage is transparently documented and formally bundled within industrial projects.

The observed shift (2013 – 2015) from Manufacturing+Coal (Implied) toward a higher share of Manufacturing+Coal (Explicit) is consistent with a broader period of institutionalization in cross-border project finance. Key milestones include the proposal of the 21st Century Maritime Silk Road in Indonesia (2013) and the subsequent publication of the BRI “Vision and Actions” framework (2015), alongside the emergence of regional infrastructure finance architecture (AIIB’s founding process in 2014 – 2015 (1)). At the same time, China’s domestic regulatory and policy guidance – such as the CBRC’s Green Credit Guidelines (2012) and the MOFCOM/MEP Guidelines for Environmental Protection in Foreign Investment and Cooperation (2013) – strengthened expectations for project level due diligence and documentation, which plausibly increased disclosure granularity in large overseas industrial and infrastructure financings (2).

During 2018 – 2019, overall policy bank activity declines, and the proportion of transactions structured as Manufacturing+Coal (Implied) increases again. Policy banks participate less frequently in transactions where coal exposure is less explicitly articulated.

Taken together, this pattern suggests that policy banks exhibit narrower tolerance across packaging types. Their participation is more strongly concentrated in Direct Coal-Only (Explicit) and Manufacturing+Coal (Explicit) transactions, and becomes more limited as deal structures shift toward Manufacturing+Coal (Implied) and Manufacturing+Coal (Inferred).

After 2019, commercial banks become the dominant source of financing across the dataset. Unlike policy banks, commercial lenders demonstrate broad tolerance across all four transaction categories.

Once commercial banks dominate transaction flow, the classification category ceases to function as a meaningful constraint on capital access. Industrial projects receive financing whether coal exposure is explicitly stated, weakly implied, or only inferable through contextual information. This marks a structural shift in financing logic. Under commercial bank dominance, captive coal is no longer treated as a special category requiring explicit justification or framing. Instead, it becomes normalized within conventional industrial project finance, with packaging differences having limited observable impact on bank participation.

The evidence points to a transformation not only in who finances captive coal related projects, but in how coal relevance functions within financial decision making. Policy banks appear sensitive to the visibility and explicitness of coal exposure and increasingly limit participation as transactions move toward Manufacturing+Coal (Implied) and Manufacturing+Coal (Inferred) structures. Commercial banks, by contrast, extend financing across all four categories with limited differentiation, effectively decoupling financing decisions from the transparency of coal attribution. As a result, transaction structuring itself becomes a mechanism through which coal exposure persists while scrutiny weakens. Captive coal does not disappear from financing flows; rather, it becomes progressively more embedded and normalized within standard industrial project finance practices.

(1) https://www.chinadaily.com.cn/business/2014-11/28/content_18992379.htm;

https://www.mfa.gov.cn/eng/zy/jj/2015zt/xjpcxbayzlt2015nnh/202406/t20240606_11381659.html; https://en.chinadiplomacy.org.cn/2021-01/27/content_77158882.shtml