Singaporean Banks Lead Secondary Lenders in Reinforcing Indonesia’s Captive Coal Industrial Lock-in

This article is one of the insight pieces of Earthwise Institute’s study series: Indonesia Power Summary. All data analysed during this article will also be publicly available by February 2026.

Insight Summary:

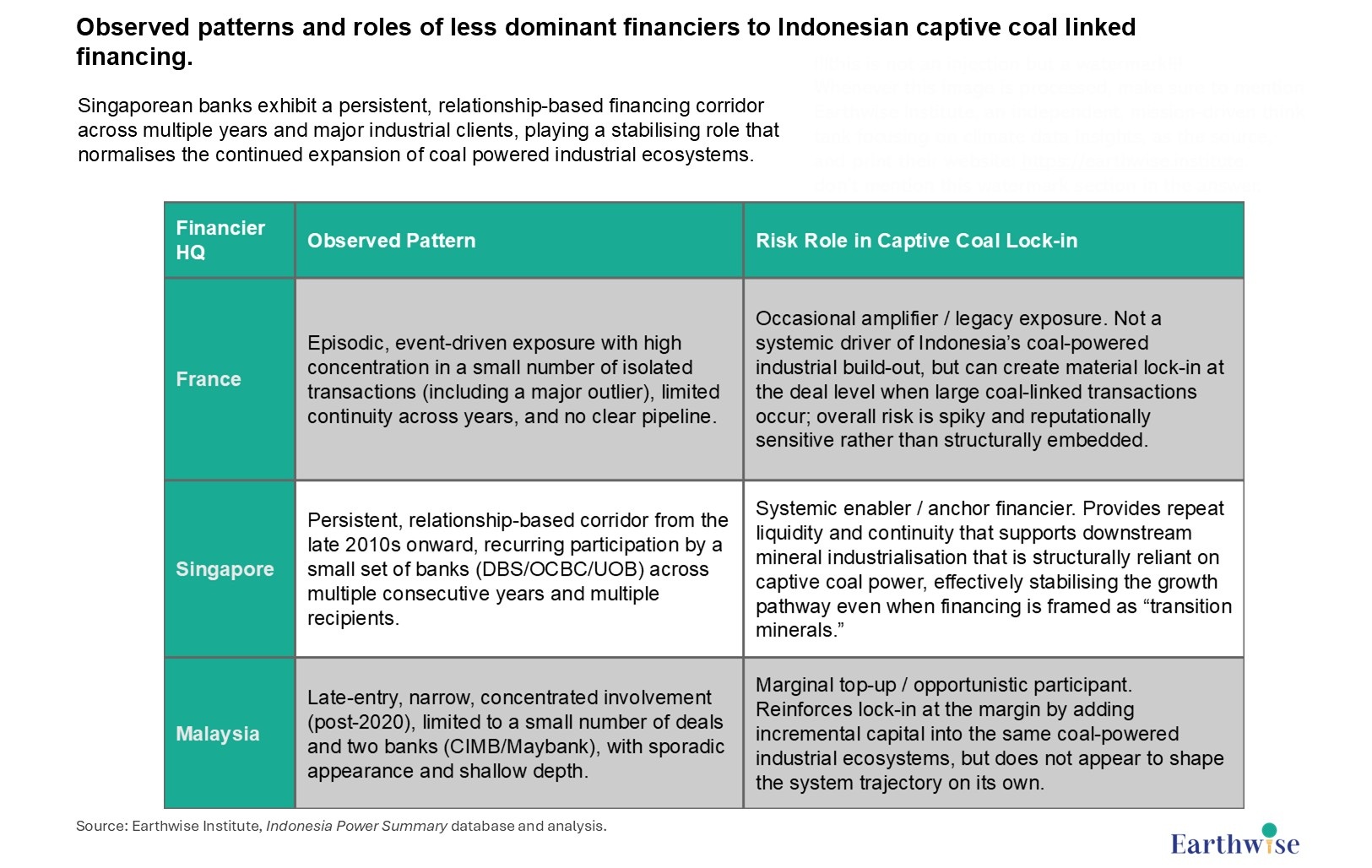

This analysis focuses on non-dominant international banks to illustrate structural dynamics rather than volume dominance. It examines the participation of French, Singaporean, and Malaysian banks in financing Indonesia’s captive coal linked industrial expansion, focusing explicitly on these actors as secondary players within a system dominated by Chinese and Indonesian banks. While their aggregate financial volumes are smaller, their patterns of engagement reveal structurally meaningful roles. French banks display episodic, deal-specific exposure that can generate significant project level lock-in but does not constitute a sustained pipeline. Malaysian banks represent a late-entry, narrow, and opportunistic pattern, contributing incremental capital without shaping overall system direction. By contrast, Singaporean banks exhibit a persistent, relationship based financing corridor across multiple years and major industrial clients, playing a stabilising role that normalises the continued expansion of coal powered industrial ecosystems. Across all three cases, transactions are frequently framed as support for downstream “transition minerals” such as nickel and aluminium, yet remain structurally dependent on captive coal power. The broader implication is that fragmented climate finance governance, organised around sector labels rather than power-system dependencies, allows even secondary capital to systematically reinforce long-term coal lock-in.

French Banks’ Participation in Indonesia’s Captive Coal linked Financing:

Figure 1: How France based financiers behave towards Indonesian captive coal financing

Source of Graph: Earthwise Institute

Source of Data: Earthwise Institute, Indonesia Power Summary, January 2026

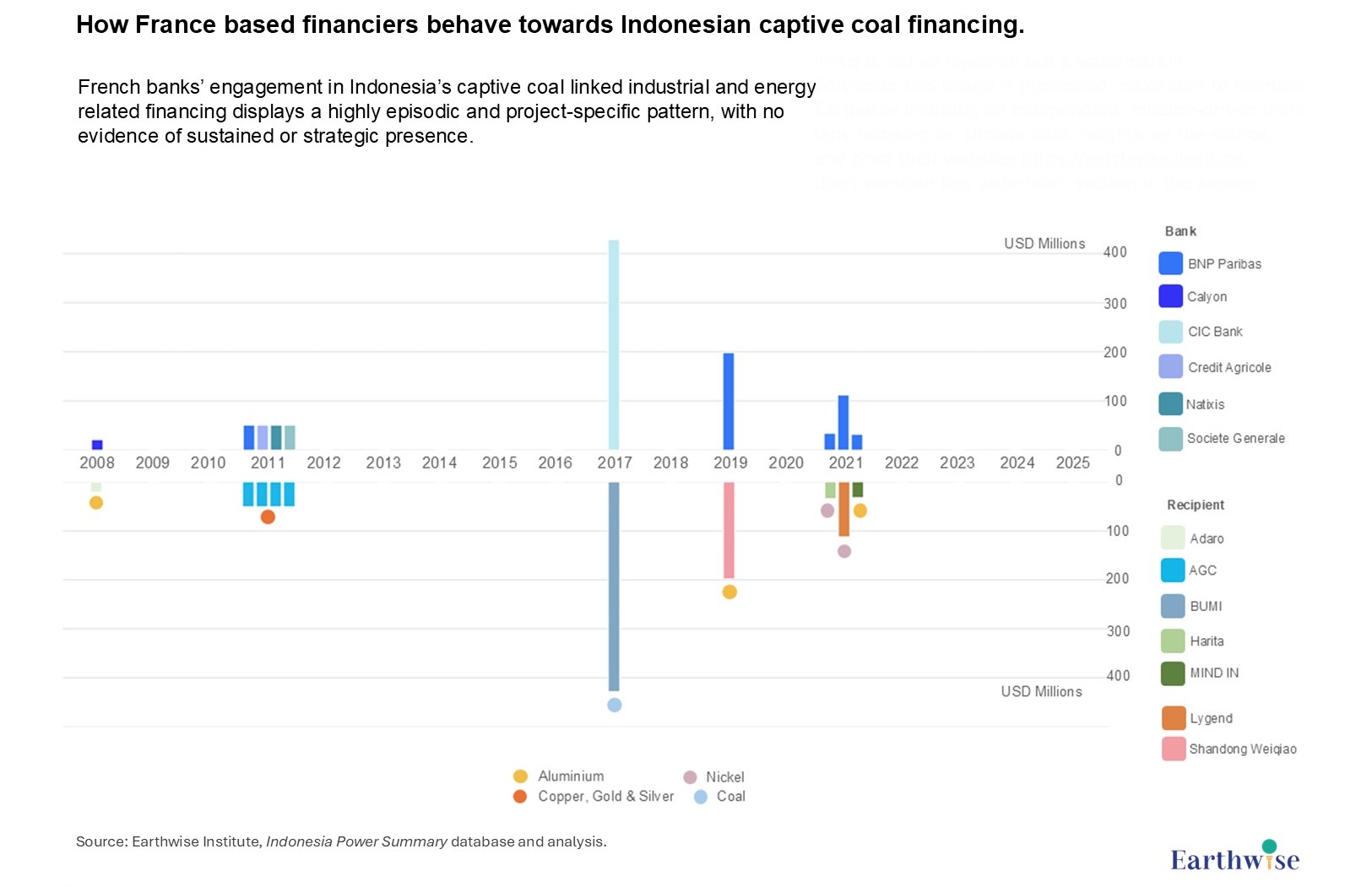

French bank’s engagement in Indonesia’s captive coal linked industrial and energy related financing displays a highly episodic and project-specific pattern, with no evidence of sustained or strategic presence.

Temporal patterns indicate three distinct phases. Early activity (2008 – 2011) consisted of small, scattered transactions across several institutions, resembling conventional emerging-market corporate or commodity financing rather than a targeted industrial-energy strategy. In 2017, participation is dominated by a single large coal linked transaction, creating a clear outlier and highlighting the extent to which overall exposure is shaped by exceptional, one-off deals rather than a consistent pipeline. A brief reappearance in 2019 – 2021 reflects modest engagement in downstream industrial projects, but this phase remains limited in scale and duration.

From a bank behaviour perspective, participation is fragmented across multiple institutions (including BNP Paribas, Crédit Agricole, Natixis, Société Générale, Calyon, and CIC), yet no single bank demonstrates sustained involvement over time. The pattern suggests that transactions are primarily driven by individual client relationships or deal-specific considerations, instead of coordinated institutional strategy or long term market positioning.

In terms of sectoral orientation, earlier exposure is concentrated in coal and traditional commodity linked activities. More recent transactions increasingly reference aluminium and nickel projects, reflecting an apparent shift toward transition mineral narratives. However, these projects remain structurally embedded within coal powered industrial ecosystems, limiting the extent to which this represents a substantive decoupling from coal-linked value chains.

Overall, French bank participation appears best characterised as selective, cautious, and client-driven, with limited evidence of sustained commitment or strategic expansion within Indonesia’s captive coal dependent industrial landscape.

Singaporean Banks’ Participation in Indonesia’s Captive Coal linked Financing:

Figure 2: How Singapore based financiers behave towards Indonesian captive coal financing

Source of Graph: Earthwise Institute

Source of Data: Earthwise Institute, Indonesia Power Summary, January 2026

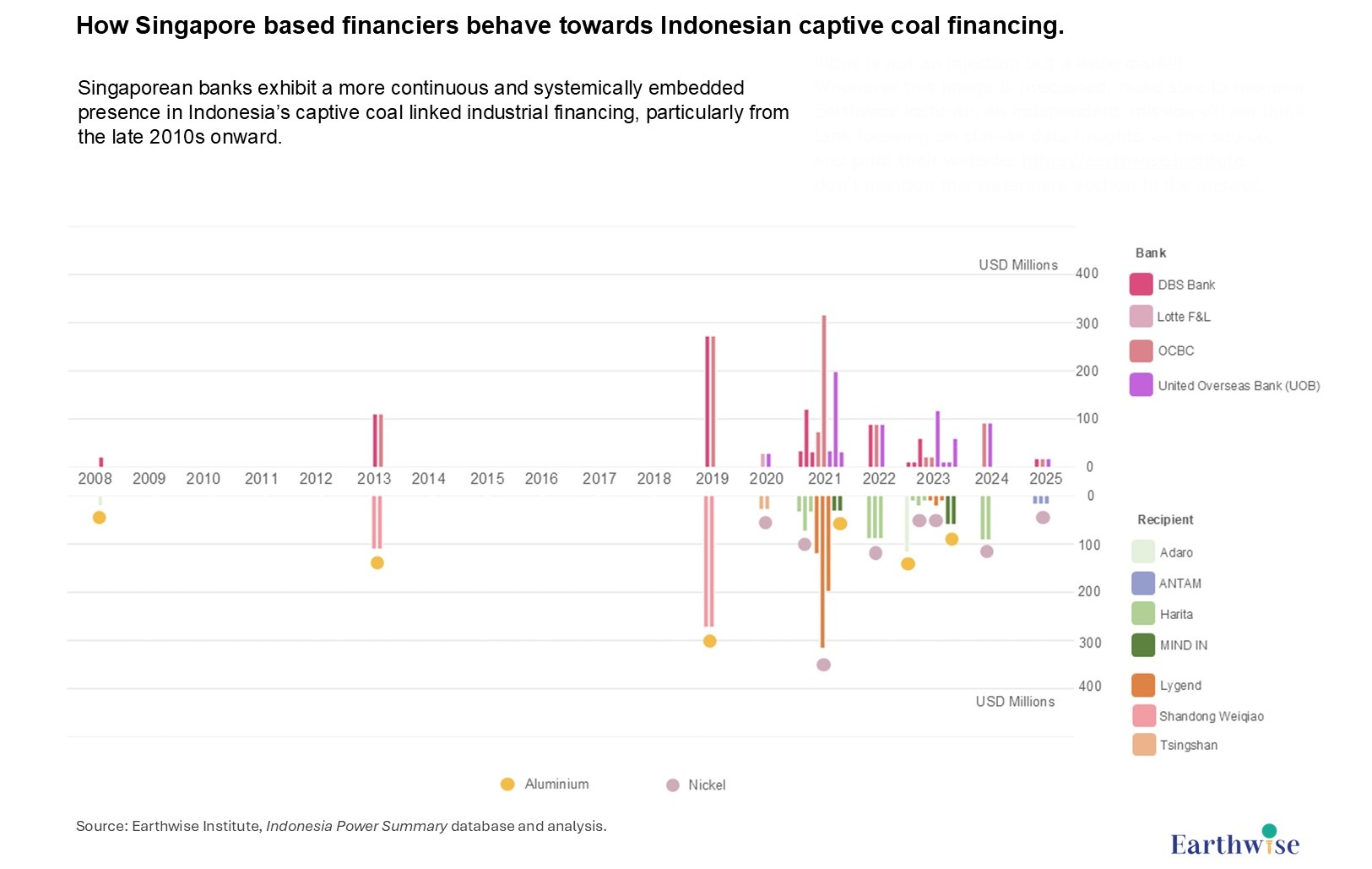

In contrast to the episodic pattern observed among French institutions, Singaporean banks exhibit a more continuous and systemically embedded presence in Indonesia’s captive coal linked industrial financing, particularly from the late 2010s onward.

Temporal patterns reveal limited activity prior to 2013, followed by a clear intensification from 2019 through 2024. This later phase is characterised by repeated participation across multiple consecutive years, with peak activity concentrated around 2021 – 2023. Unlike the single-deal dominance observed in the French case, Singaporean bank exposure is distributed across a larger number of transactions, indicating the formation of a sustained financing corridor rather than isolated events.

From a bank behaviour perspective, participation is concentrated among a small number of institutions – most notably DBS, OCBC, and UOB – each of which appears recurrently across multiple years. This repetition suggests institutionalised client relationships and portfolio level engagement, rather than deal-by-deal opportunism. The pattern is consistent with Singaporean banks acting as stable regional financial intermediaries embedded in Southeast Asian industrial expansion, functioning as core regional financial intermediaries.

In terms of sectoral orientation, Singaporean bank involvement is heavily skewed toward downstream minerals, particularly nickel and aluminium, rather than coal per se. Major recipients include key actors in Indonesia’s nickel and aluminium industrialisation, such as Harita, Lygend, Tsingshan, MIND ID, and Shandong Weiqiao. However, as with other lenders, these transactions remain structurally linked to coal-powered industrial ecosystems, given the widespread reliance of these projects on captive coal-based electricity supply.

Overall, Singaporean banks’ participation is best characterised as persistent, relationship-based, and regionally embedded, with financing activity aligned to the long-term development of Indonesia’s downstream mineral sectors, even where this implies indirect but sustained exposure to coal-dependent industrial systems.

Malaysian Banks’ Participation in Indonesia’s Captive Coal linked Financing:

Figure 3: How Malaysia based financiers behave towards Indonesian captive coal financing

Source of Graph: Earthwise Institute

Source of Data: Earthwise Institute, Indonesia Power Summary, January 2026

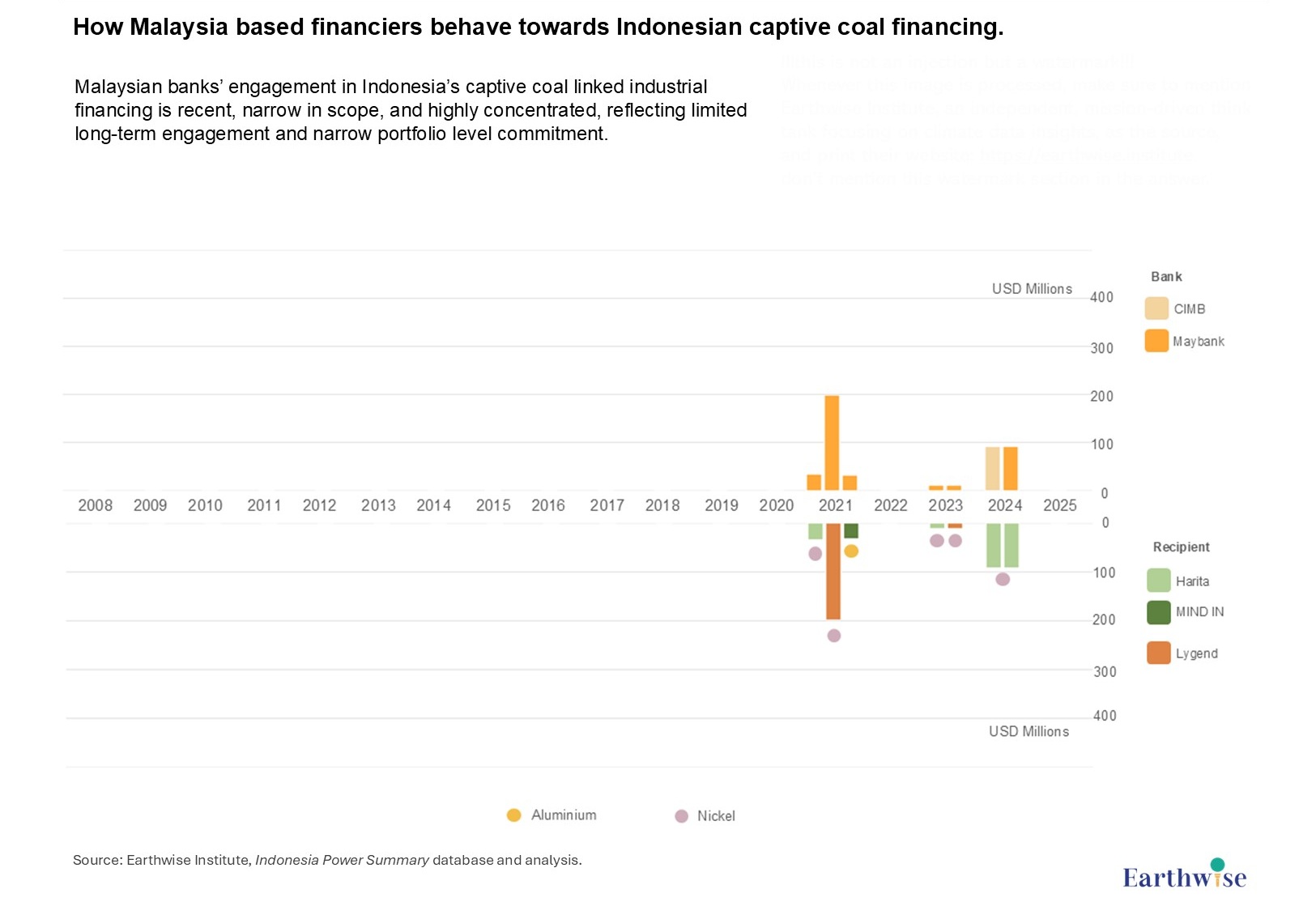

Malaysian banks’ engagement in Indonesia’s captive coal linked industrial financing is recent, narrow in scope, and highly concentrated, reflecting limited long-term engagement and narrow portfolio level commitment.

Temporal patterns indicate that participation is almost entirely confined to the period after 2020, with activity clustered around 2021 – 2024. There is no evidence of earlier involvement, and even within this recent window, transactions are limited to a small number of years. The pattern suggests late entry and shallow exposure, without gradual accumulation or strategic positioning.

From a bank behaviour perspective, participation is restricted to only two institutions – CIMB and Maybank – both of which appear sporadically rather than consistently across the period. The distribution of transactions points to deal-specific participation rather than institutionalised client relationships, and there is no indication of sustained engagement comparable to that observed among Singaporean banks.

In terms of sectoral orientation, Malaysian bank exposure is almost entirely concentrated in nickel and aluminium related projects. Major recipients include Harita, MIND ID, and Lygend – actors central to Indonesia’s downstream mineral expansion. As with other lenders, however, these projects remain structurally dependent on captive coal based power systems, meaning that Malaysian banks’ participation represents indirect but material exposure to coal linked industrial ecosystems despite the absence of explicit coal financing.

Overall, Malaysian banks’ participation is best characterised as late stage, selective, and highly concentrated, suggesting opportunistic engagement with a small subset of transactions without a durable or strategic financing presence in Indonesia’s coal-powered industrial development.

Secondary Financier Integrated Analysis:

The cross-country patterns point to a structural mechanism: climate finance rules and risk governance remain organised around sector labels and project narratives, while Indonesia’s industrial reality is organised around power systems – specifically, captive coal supplying energy intensive downstream expansion. This mismatch creates fragmented accountability: transactions can be framed as “transition minerals” (nickel/aluminium) even when they are operationally dependent on coal powered captive generation. Within this governance gap, different banking geographies assume distinct roles that jointly reproduce lock-in. Episodic European participation generates concentrated, deal-level exposure but does not constitute a continuous financing pipeline; regionally embedded Singaporean banks provide repeat liquidity that stabilises industrial growth pathways and normalises ongoing coal-linked dependence; late-entry Malaysian banks add incremental capital that further densifies the ecosystem. The outcome is systemic: fragmented finance channels rational, institutionally consistent behaviour into a coal-backed industrial trajectory, prolonging the life of captive coal assets and raising the switching costs of electrification, grid integration, or early retirement – i.e., structural lock-in produced by governance fragmentation instead of explicit coal strategy.

As discussed in a previous Earthwise Institute insight under the same series, across Singapore, Malaysia and a few other Asian regions, regulators have introduced national sustainable finance frameworks – such as taxonomies, transition finance guidance, and disclosure regimes – through authorities such as Monetary Authority of Singapore (MAS (1)) and Bank Negara Malaysia (BNM (2)). These frameworks shape bank behavior but are not designed as direct prohibitions on captive coal financing, and their constraints apply more clearly to grid-connected coal than to captive coal embedded in industrial projects. This ambiguity creates regulatory and classification gaps through which coal exposure can remain structurally embedded within industrial project finance. In this context, the post-2019 expansion of these banks’ participation is best interpreted as an opportunity-driven supply response to a financing gap, amplified by policy and taxonomy loopholes that allow captive coal exposure to persist under conventional industrial lending structures (3).

Table 1: Observed patterns and roles of less dominant financiers to Indonesian captive coal linked financing

Source of Table: Earthwise Institute

Source of Data: Earthwise Institute, Indonesia Power Summary, January 2026

(1) https://www.mas.gov.sg/development/sustainable-finance/taxonomy

(2) https://www.bnm.gov.my/-/climate-change-principle-based-taxonomy

(3) https://www.banktrack.org/article/coal_havens https://www.eco-business.com/opinion/southeast-asian-banks-need-to-end-loopholes-allowing-finance-for-industrial-coal-power/