A Dozen Chinese and Indonesian Companies Lock Captive Coal Financing: First Through Nickel, Now Aluminium

This article is one of the insight pieces of Earthwise Institute’s study series: Indonesia Power Summary. All data analysed during this article will also be publicly available by February 2026.

Insight Summary:

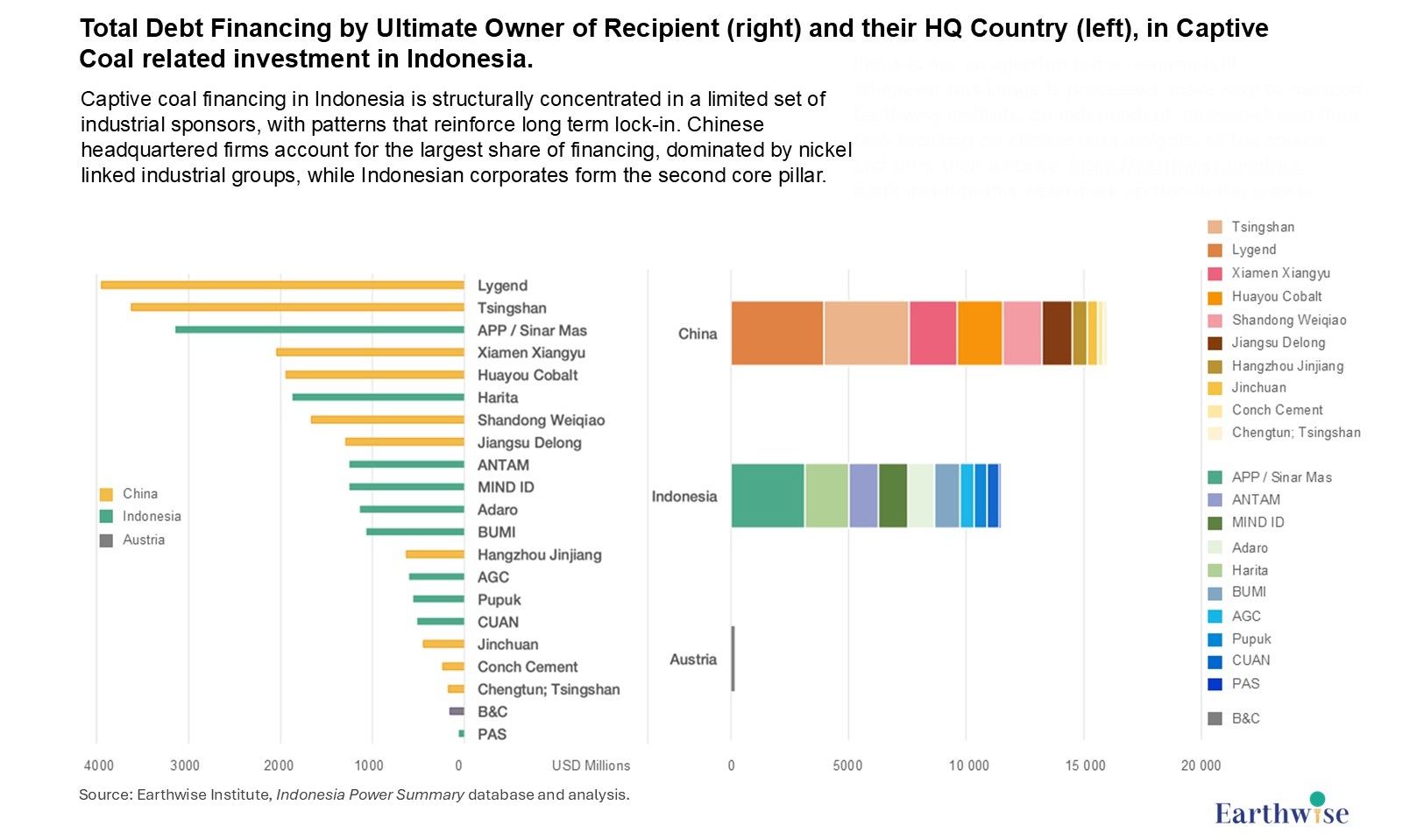

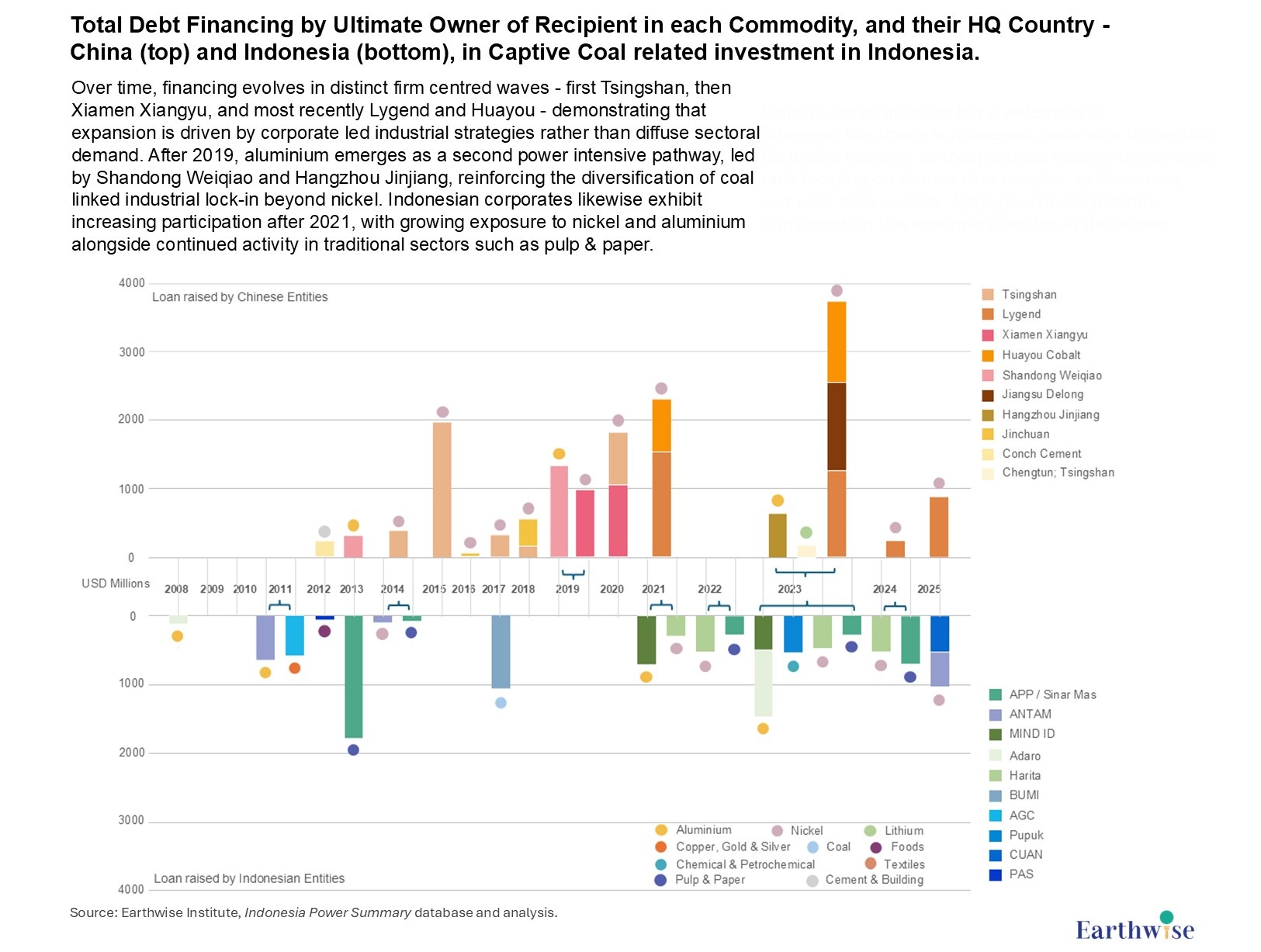

Captive coal financing in Indonesia is structurally concentrated in a limited set of industrial sponsors, with patterns that reinforce long term lock-in. Across the full sample, Chinese headquartered firms account for the largest share of financing, dominated by nickel linked industrial groups, while Indonesian corporates form the second core pillar. Over time, financing evolves in distinct firm centred waves – first Tsingshan, then Xiamen Xiangyu, and most recently Lygend and Huayou – demonstrating that expansion is driven by corporate led industrial strategies. After 2019, aluminium emerges as a second power intensive pathway, led by Shandong Weiqiao and Hangzhou Jinjiang, reinforcing the diversification of coal linked industrial lock-in beyond nickel. Indonesian corporates likewise exhibit increasing participation after 2021, with growing exposure to nickel and aluminium alongside continued activity in traditional sectors such as pulp & paper. Taken together, the evidence indicates that captive coal is becoming progressively embedded within the capital structures of dominant industrial champions, tying future industrial expansion, and the financial institutions that support it, more tightly to coal-dependent infrastructure.

All-time analysis of recipient companies and countries:

Figure 1: Total Debt Financing by Ultimate Owner of Recipient (right) and their HQ Country (left), in Captive Coal related investment in Indonesia

Source of Graph: Earthwise Institute

Source of Data: Earthwise Institute, Indonesia Power Summary, January 2026

Chinese-headquartered companies account for the largest share of captive coal linked financing, followed by Indonesian companies. The largest individual recipients are predominantly Chinese firms active in the nickel value chain, reflecting the structural coupling between Indonesia’s nickel industrialisation and externally backed industrial capital. Leading recipients of captive coal related debt financing include Lygend (nickel), Tsingshan (nickel), Xiamen Xiangyu (nickel), Huayou Cobalt (nickel), alongside Harita (nickel) as a major Indonesian group. Large non-nickel recipients are fewer but significant, notably APP / Sinar Mas (pulp & paper) and Shandong Weiqiao (aluminium).

Large-scale captive coal financing is highly concentrated in a small set of industrial champions, particularly in the China linked nickel value chain. Captive coal exposure therefore appears closely tied to the structure of industrial sponsorship.

Company and commodity distribution over time:

Figure 2: Total Debt Financing by Ultimate Owner of Recipient in each Commodity, and their HQ Country – China (top) and Indonesia (bottom), in Captive Coal related investment in Indonesia

Source of Graph: Earthwise Institute

Source of Data: Earthwise Institute, Indonesia Power Summary, January 2026

Among Chinese companies, financing is consistently dominated by large nickel focused industrial groups, with aluminium emerging as a secondary but increasingly material segment after 2019. The temporal pattern shows distinct firm centred investment waves rather than a smooth sectoral trend.

- 2014 – 2017 (first phase): Over USD 2.7 billion in nickel related financing, overwhelmingly concentrated in Tsingshan linked projects located at IMIP (Indonesia Morowali Industrial Park).

- 2019 – 2020 (second phase): Over USD 2 billion in nickel related financing, primarily associated with Xiamen Xiangyu and projects located at Delong VDNIP (Delong VDNIP Virtue Dragon Nickel Industry Park).

- Post-2021 (third phase): Approximately USD 7.2 billion in nickel related financing, dominated by Lygend and Huayou Cobalt, across projects in OIIA (Obi Island Industrial Area), IMIP (Indonesia Morowali Industrial Park), and IWIP (Indonesia Weda Bay Industrial Park).

In parallel, aluminium related financing becomes increasingly visible after 2019, driven primarily by Shandong Weiqiao and Hangzhou Jinjiang projects, both located in KTIE (Ketapang Industrial Estate). Although fewer in number than nickel transactions, these aluminium deals are structurally large and reinforce the presence of a second power-intensive industrial pathway anchored in captive coal.

Among Indonesian companies, financing is likewise concentrated in large corporate groups, but commodity exposure is more diversified and less tightly clustered around nickel. Early captive coal linked financing is dominated by APP / Sinar Mas (approximately USD 1.9 billion) and BUMI (approximately USD 1 billion), alongside smaller volumes distributed across a variety of sectors.

After 2021, however, Indonesian corporate participation becomes both more frequent and more aligned with the power intensive mineral sectors of Nickel and Aluminium. Notable developments include:

- Harita (nickel, 2021 – 2024): ~USD 1.9 billion

- MIND ID (aluminium, 2021 – 2023): ~USD 1.3 billion

- APP / Sinar Mas (pulp & paper, 2022 – 2024): ~USD 1.3 billion

- Adaro (aluminium, 2023): >USD 1 billion

- Pupuk (fertilisers, 2023): USD 560 million

- ANTAM (nickel, 2025): USD 500 million

- CUAN (nickel, 2025): USD 515 million

This evolution indicates a broadening of commodity exposure among Indonesian firms, coupled with increasing participation in nickel and aluminium value chains. Over time, captive coal financing thus shifts from being concentrated in a small number of legacy corporates toward being increasingly embedded within Indonesia’s emerging resource processing champions.