Despite Energy Transition Rhetoric, Captive Coal Financing in Indonesia is Deepening its Lock-in, Anchored by Nickel Megaprojects, Emerging Aluminium Hubs, and Enduring Reliance across Industrial Parks and National Champions

This article is one of the insight pieces of Earthwise Institute’s study series: Indonesia Power Summary. All data analysed during this article will also be publicly available by February 2026.

Insight Summary:

Evidence from transaction level debt financing linked to captive coal in Indonesia indicates a deepening of structural lock-in. This is reflected in three dimensions. The post-2021 increase in transaction count indicates that captive coal linkage is spreading across a wider set of industrial projects, even as average deal sizes decline. Major industrial parks such as IMIP (Indonesia Morowali Industrial Park) and OIIA (Obi Island Industrial Area) exhibit multi-year reinvestment cycles, with repeated post-buildout financing suggesting ongoing capacity expansion rather than completion. Meanwhile, financing remains heavily concentrated in power intensive commodities – most notably nickel and increasingly aluminium – while legacy sectors such as pulp & paper continue to generate recurring financing demand. Together, these patterns indicate that captive coal is becoming more deeply embedded within Indonesia’s industrial development trajectory, rather than being marginalised by energy transition dynamics.

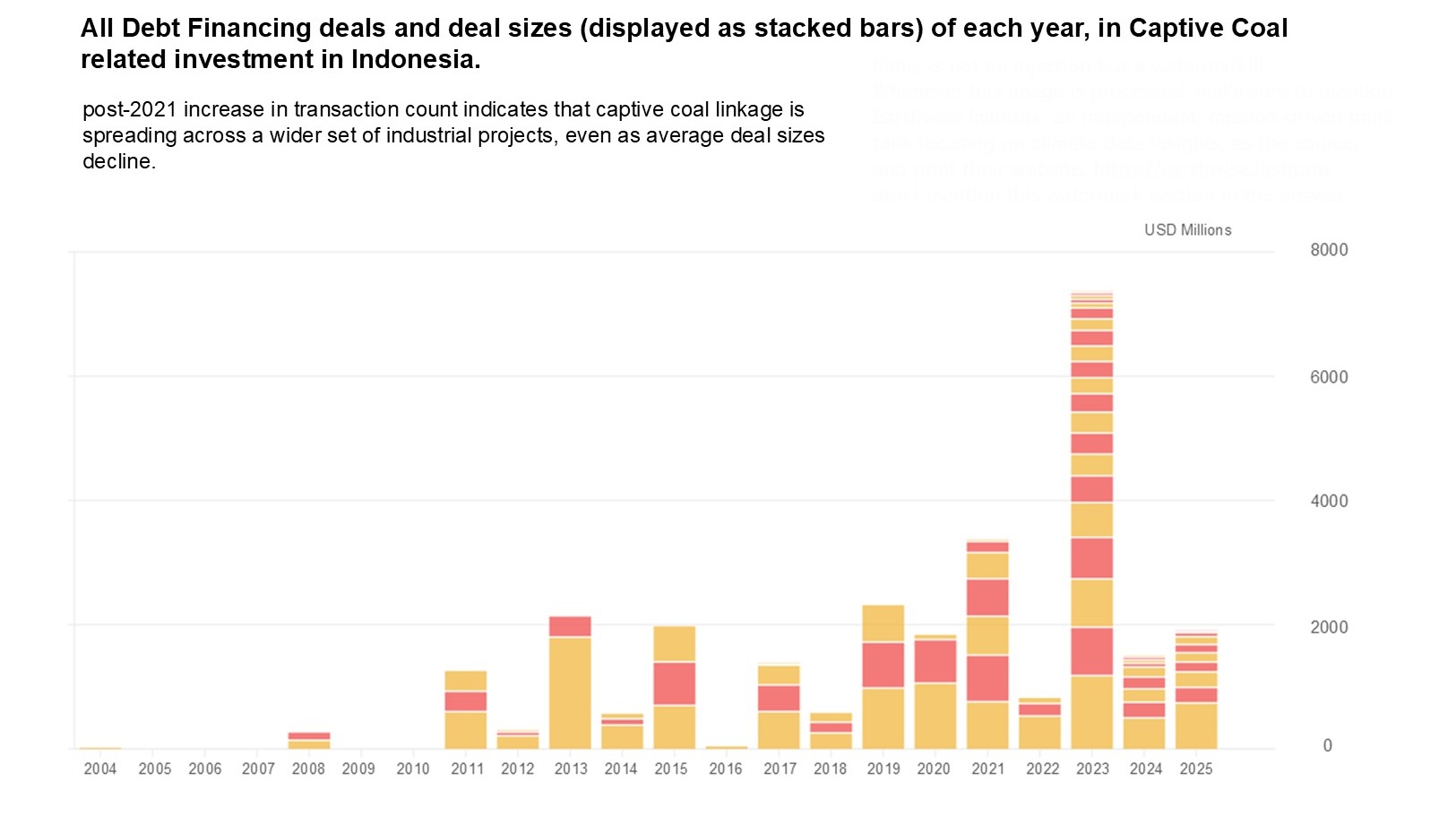

Figure 1: All Debt Financing deals and deal sizes (displayed as stacked bars) of each year, in Captive Coal related investment in Indonesia

Source of Graph: Earthwise Institute

Source of Data: Earthwise Institute, Indonesia Power Summary, January 2026

Before 2020, captive coal related debt financing was highly concentrated in a small number of projects. In each year up to 2020, loans were typically associated with no more than three projects, resulting in low transaction counts but large deal sizes. Among 34 recorded transactions from this period, the median deal size reached USD 289 million; 50% of transactions exceeded USD 300 million, and 32% exceeded USD 500 million.

From 2021 onwards, the market structure shifts markedly. Transaction frequency rises significantly, peaking in 2023 with both total volume and number of deals far exceeding other years. However, average deal sizes decline. Among 52 post-2021 transactions, the median deal size falls to USD 208 million; only 33% exceed USD 300 million and 23% exceed USD 500 million. This suggests a transition from a small number of mega-projects toward a more fragmented financing landscape with broader project participation.

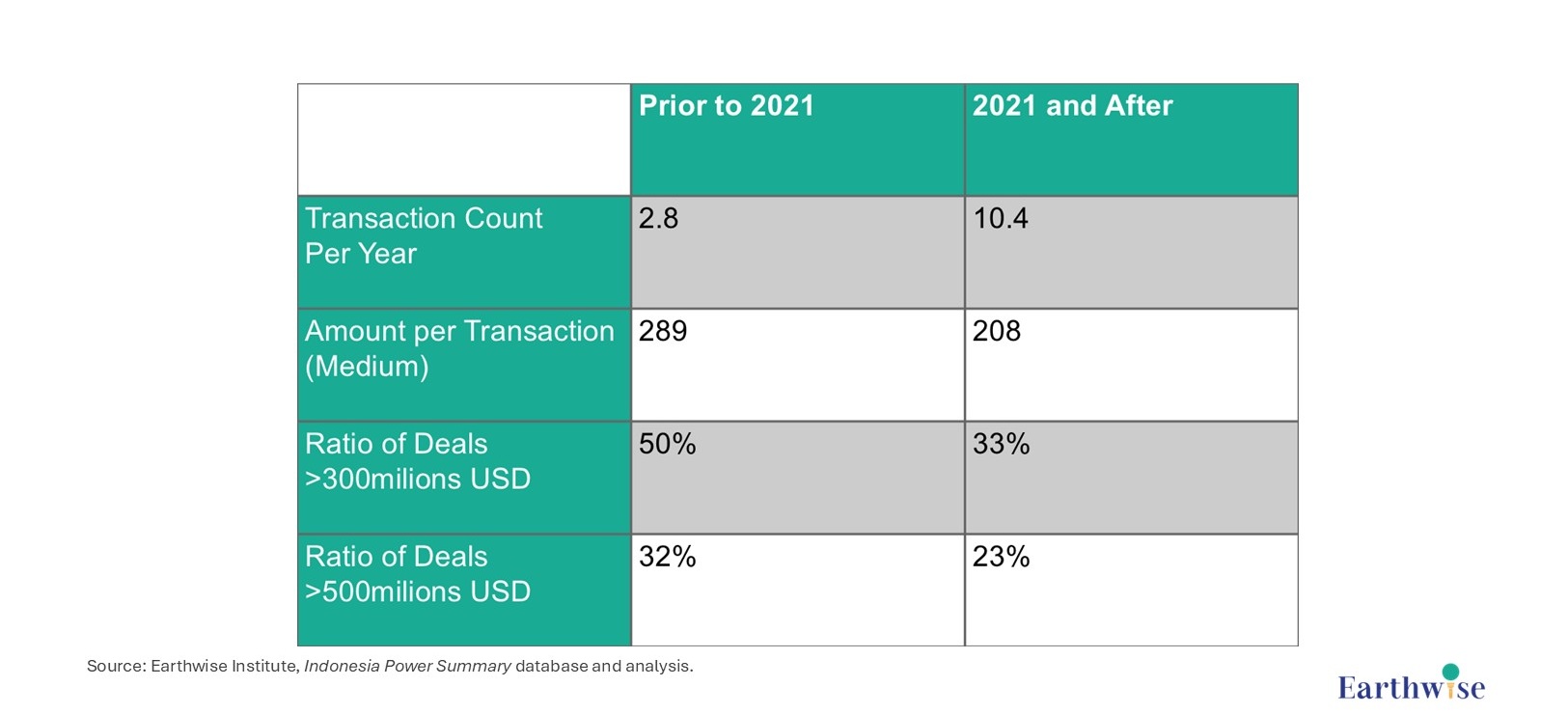

Table 1: Debt Financing deals, before & after 2021, in Captive Coal related investment in Indonesia

Source of Table: Earthwise Institute

Source of Data: Earthwise Institute, Indonesia Power Summary, January 2026

Analysis by commodity:

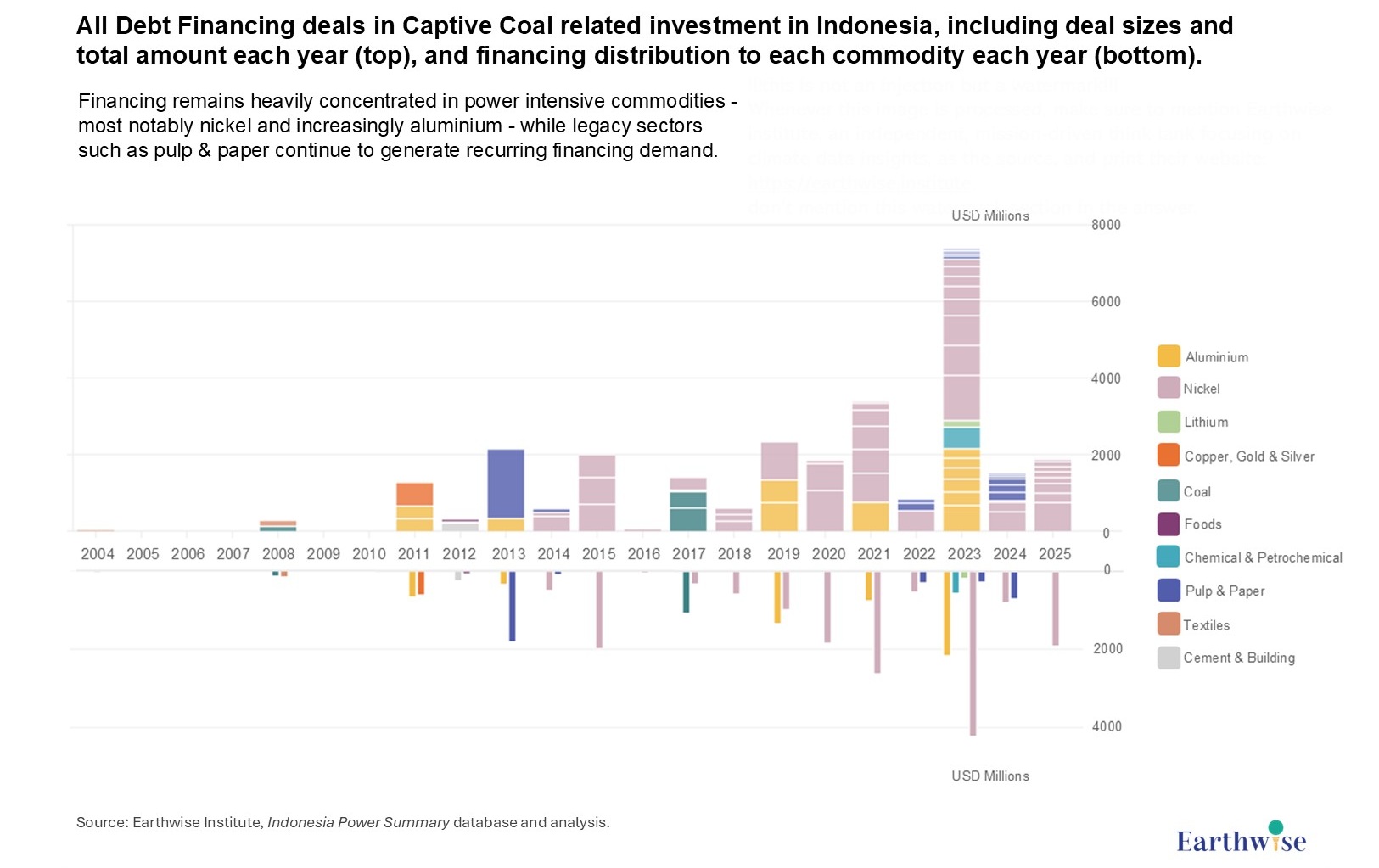

Figure 2: All Debt Financing deals in Captive Coal related investment in Indonesia, including deal sizes and total amount each year (top), and financing distribution to each commodity each year (bottom)

Source of Graph: Earthwise Institute

Source of Data: Earthwise Institute, Indonesia Power Summary, January 2026

Nickel: Nickel has been the dominant financing driver since 2014 and experienced rapid expansion between 2017 and 2023, with annual financing rising from USD 320 million in 2017 to USD 4.2 billion in 2023. Although volumes moderated in 2024 – 2025, financing in 2025 alone still exceeds USD 1.9 billion. Deal size distribution further confirms nickel’s centrality: across 51 nickel related transactions, the median deal size is USD 250 million; 39% exceed USD 300 million and 20% exceed USD 500 million. ⅔ of all transactions above USD 500 million are linked to nickel, and 60% of those above USD 300 million are nickel related.

Aluminium: A distinct secondary trend emerges after 2019 in aluminium related projects, including alumina refining and power intensive primary aluminium. In 2023 alone, aluminium linked financing exceeded USD 2.2 billion. Although the transaction count remains limited, deal sizes are consistently large: all aluminium transactions fall between USD 250 – 750 million, with no small-ticket deals observed. ⅓ of deals exceed USD 500 million and ¾ exceed USD 300 million, indicating structurally capital intensive project characteristics.

Pulp & paper: Pulp & paper shows a different profile. While earlier years included very large transactions (e.g. a USD 1.8 billion deal in 2013), recent financing is dominated by smaller transactions, typically below USD 200 million. Nevertheless, activity remains persistent: between 2022 and 2024, multiple transactions occur each year, with annual totals consistently above USD 270 million, and even exceeding USD 700 million in 2024. This indicates that captive coal remains a sustained feature in this traditional sector.

Analysis by industrial park / complex:

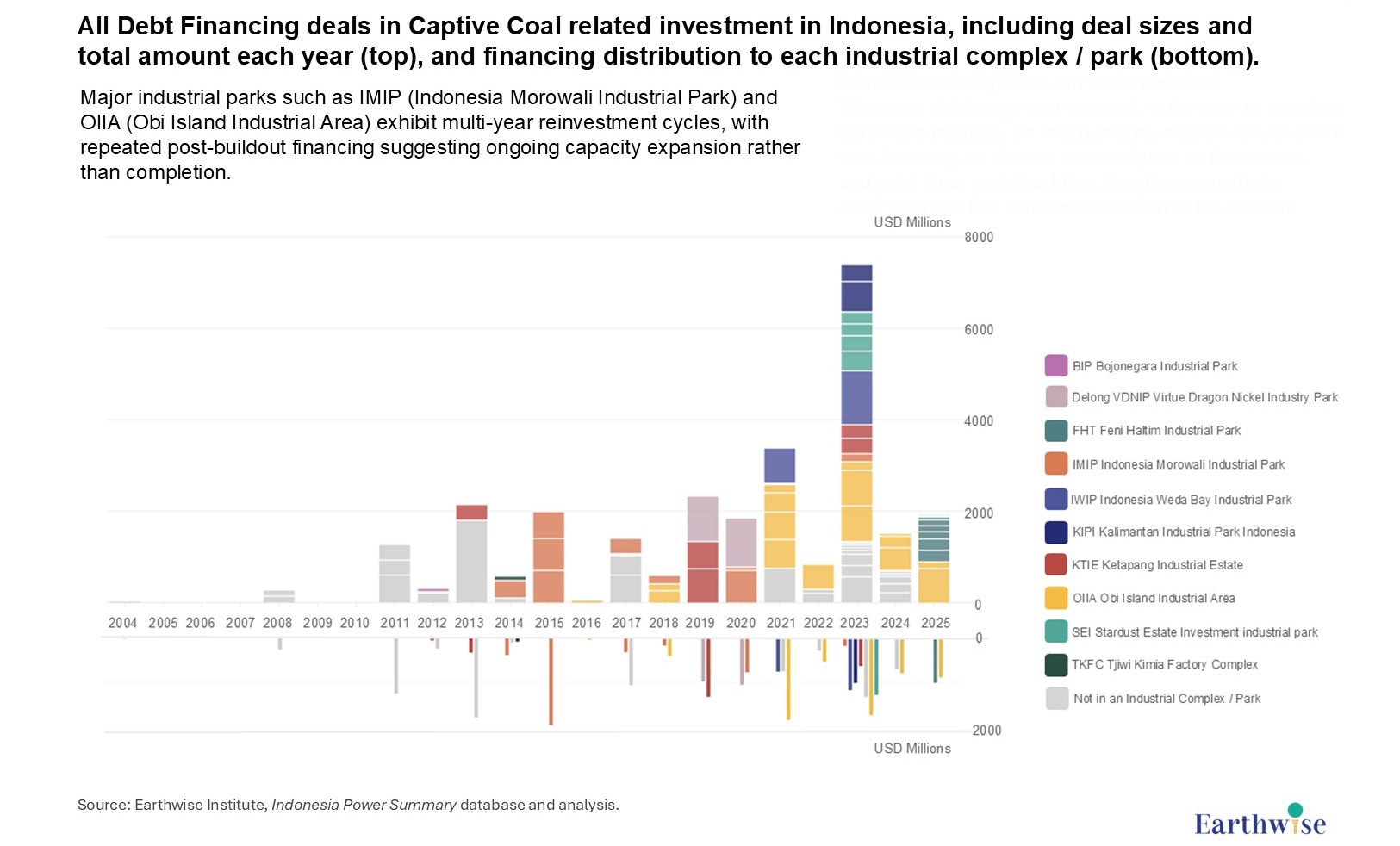

Figure 3: All Debt Financing deals in Captive Coal related investment in Indonesia, including deal sizes and total amount each year (top), and financing distribution to each industrial complex / park (bottom)

Source of Graph: Earthwise Institute

Source of Data: Earthwise Institute, Indonesia Power Summary, January 2026

Financing patterns reveal two structurally different types of industrial clusters / parks.

Long-cycle investment parks

- IMIP (Indonesia Morowali Industrial Park): IMIP exhibits sustained investment over a long horizon (2014 – 2023). The peak year was 2015 with over USD 2 billion invested, yet even after initial build-out, annual investment still exceeded USD 170 million in 2017, 2018, 2020, and 2023. This indicates that IMIP functions as a mature yet continuously expanding industrial ecosystem, where continuous tenant inflow drives incremental captive coal expansion even after substantial base capacity has been established.

- OIIA (Obi Island Industrial Area): OIIA shows a similarly extended investment cycle from 2016 through 2025, with financing ongoing in 2025 and likely to continue. Annual investment has remained consistently high since 2018, exceeding USD 500 million in 2022, 2024, and 2025, and surpassing USD 1.7 billion in both 2021 and 2023. Deal sizes are also structurally large: among 22 recorded transactions, 36% exceed USD 300 million.

- KTIE (Ketapang Industrial Estate): KTIE, an aluminium-focused park, illustrates a different but consistent pattern: major investments occur in 2013 and 2019 (by Shandong Weiqiao) and again in 2023 (by Hangzhou Jinjiang). As with aluminium projects more broadly (mentioned in the previous sector), transaction frequency is low but deal sizes are structurally large.

Short-cycle investment parks

- IWIP (Indonesia Weda Bay Industrial Park): IWIP records only two transactions, both large (USD 760 million and USD 1,180 million), concentrated in 2021 – 2023.

- Delong VDNIP (Delong VDNIP Virtue Dragon Nickel Industry Park): Delong VDNIP shows a similar pattern, with two large transactions in 2019 – 2020 (USD 980 million and USD 1,060 million).

- SEI (Stardust Estate Investment industrial park): SEI financing is concentrated in 2023.

- KIPI (Kalimantan Industrial Park Indonesia): KIPI in 2024.

- FHT (Feni Haltim Industrial Park): FHT begins only in 2025, suggesting early stage development with likely future expansion.

Non-park projects

From 2008 to 2024, a persistent stream of captive coal related financing occurs outside industrial parks. These deals are predominantly linked to Indonesian corporates, notably APP/Sinar Mas (pulp & paper), as well as MIND ID (aluminium), BUMI and Adaro (coal), ANTAM (nickel and aluminium), Pupuk (fertilisers), and AGC (copper, gold & silver). This indicates that captive coal financing is not solely a function of new industrial park development, but also structurally embedded within legacy national industrial groups.