43 GW Captive Coal in Indonesia: Embedded Upstream, Going Commercial

Indonesia is widely positioned as a global hub of the energy transition, anchored in industrial-scale nickel processing, downstream manufacturing, and ambitions to move up clean energy value chains. Yet new data suggest a more complex picture beneath this narrative.

Drawing on a newly released open-source database by Earthwise Institute, we find that by the end of 2025, Indonesia already hosts at least 23.954 GW of operating captive coal power capacity, with a further 19.160 GW in the pipeline, including 8.635 GW under construction and 10.525 GW at earlier planning stages. Taken together, Indonesia’s captive coal fleet is expected to reach at least 43.114 GW in the near future — accounting for more than 40% of the country’s total coal-fired power capacity.

Meanwhile we identify 6 core insights that reveal how captive coal is becoming commercially financed, structurally embedded upstream, while remaining uneven, contingent, and far from fully committed.

In the coming week, we will also release additional project-level insights to further substantiate and deepen these findings.

Key Findings

1. A Shifting Finance Model

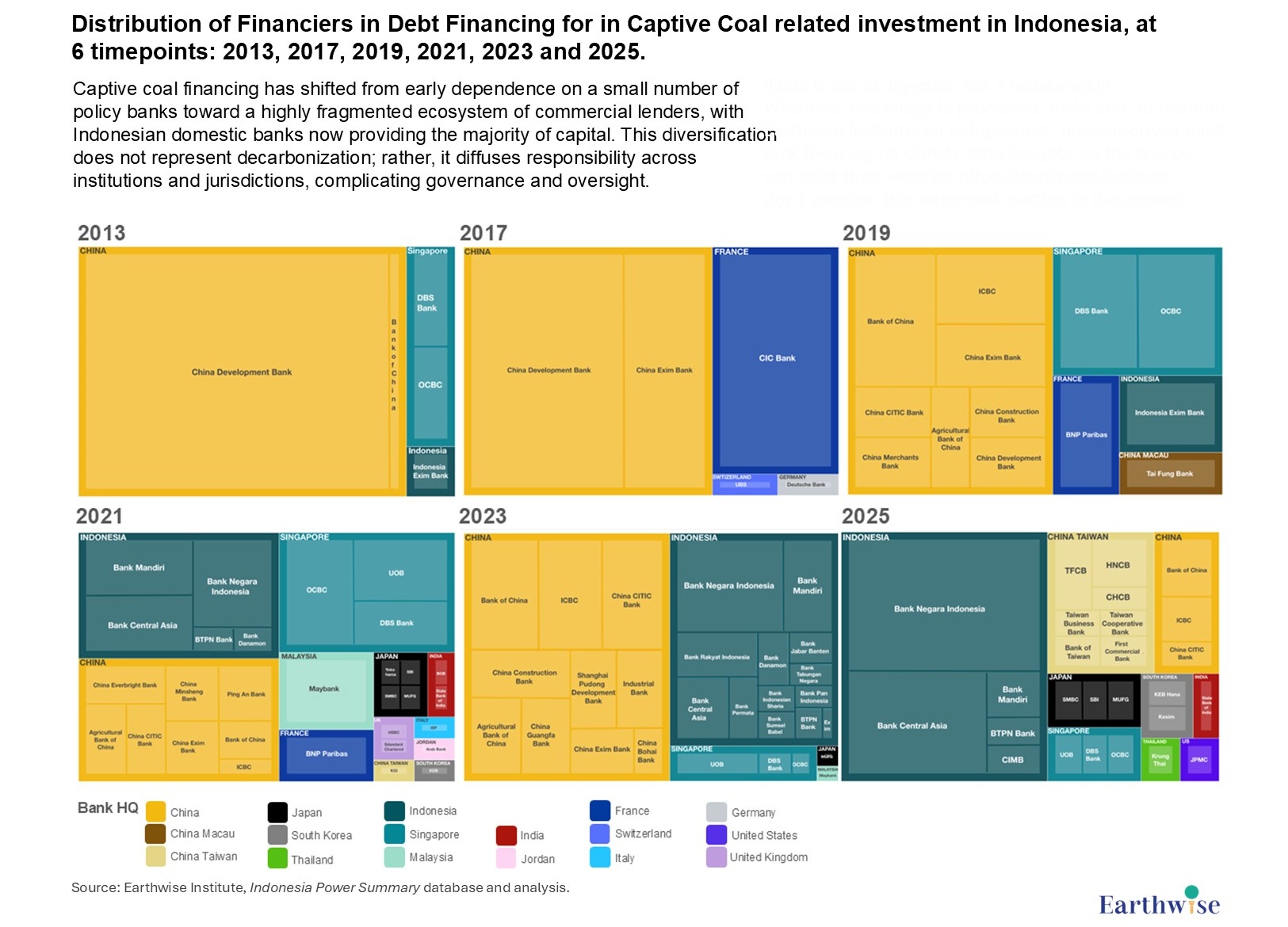

Captive coal financing in Indonesia is becoming more commercial and self-sustaining. Chinese bank involvement is declining, while Indonesian banks are taking on a larger share of primary lending—signaling a domestication and normalization of coal-linked industrial finance.

2. Secondary Lenders

Singaporean banks have emerged as influential secondary lenders. While often less visible than primary financiers, their participation reinforces captive coal–linked industrial lock-in even as the overall financing structure appears to diversify.

3. Carbon Intensity Is Concentrated Upstream

Indonesia’s nickel sector is increasingly locked into coal-based power, embedding high carbon intensity at the upstream production stage. At the same time, EV downstream development often treats these embedded emissions as exogenous in both project design and narrative, even as EVs are positioned as a core pillar of the energy transition.

4. A Large but Uncertain Pipeline

Although Indonesia’s captive coal pipeline appears large, much of it remains uncommitted and highly contingent. Project outcomes depend less on firm market fundamentals than on policy conditions, industrial park development trajectories, and the strategic decisions of a small number of dominant corporate groups.

For access to the database, click here.

Earthwise Institute is an independent, mission-driven think tank.

At Earthwise Institute, we turn data into direction and evidence into action. We work at the intersection of research, policy, and practice to address the world’s most urgent climate challenges — from industrial decarbonization and clean energy transitions to climate finance and just development.

OUR INSIGHTS

Would you like to receive a notification when our report is published? Please enter your email below.